Micron Exits Market for 3D XPoint™ Memory

The Micron Announcement

On March 16, Micron issued a press release which included the following statements:

“With immediate effect, Micron will cease development of 3D XPoint™ and shift resources to focus on accelerating market introduction of CXL-enabled memory products.”

“Micron has now determined that there is insufficient market validation to justify the ongoing high levels of investments required to successfully commercialize 3D XPoint at scale to address the evolving memory and storage needs of its customers.”

“In line with this new strategic focus, Micron is engaged in discussions for the sale of its Lehi, Utah, fab currently dedicated to 3D XPoint production. The company aims to reach a sale agreement within calendar year 2021.”

What This Means to Big Memory

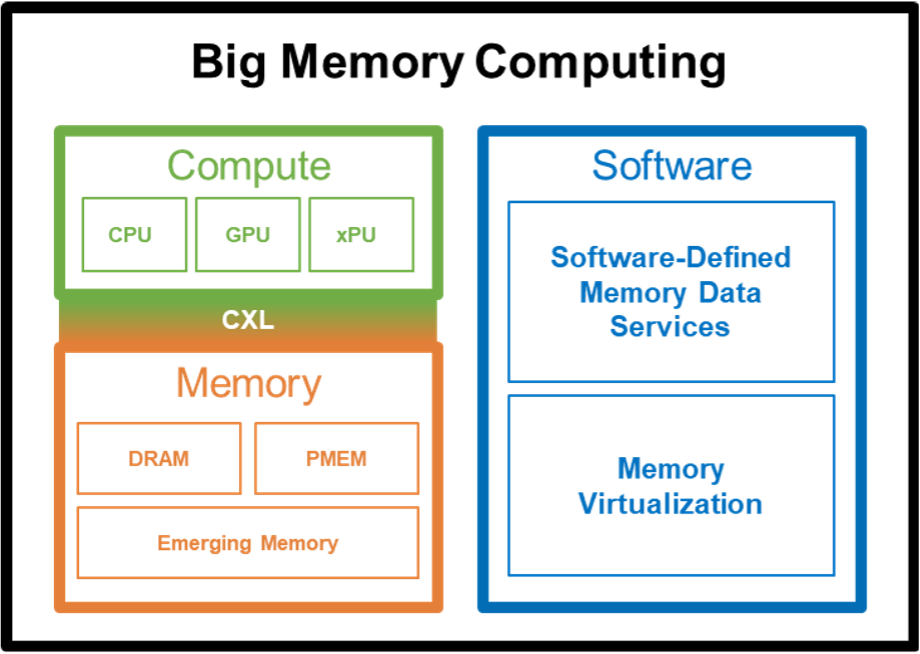

Micron exiting the 3D XPoint market has the IT industry wondering what this means to the future of persistent memory (PMEM) and Big Memory Computing consisting of DRAM, PMEM, and memory virtualization software.

The MemVerge point-of-view is:

1 – The Big Memory Imperative – there is a fundamental need for the capabilities that PMEM and Big Memory deliver. The explosive growth of real-time data and memory-centric apps calls for new memory economics, capacity, availability, and composability.

2 – Innovation – innovative new memory chips, fabric interconnects like CXL, and memory virtualization software are needed for a new class of memory infrastructure to emerge.

3 – The bottom line – is we interpret the Micron announcement to mean Micron will focus on CXL-compatible DRAM while Intel, and others in the future, will deliver CXL-compatible PMEM. Both are needed for Big Memory Computing fabrics of the future with heterogenous memory and processors.

The Big Memory Imperative

Micron remarks suggest there is insufficient market validation for PMEM and Big Memory.

MemVerge’s opinion is the growth of real-time data and memory-centric apps are market validation of strong demand for higher PMEM density and lower cost. The explosion of memory-centric apps also validates a critical need for composable, software-defined memory with capacity, performance, availability, mobility, and security that can be tailored for each app.

Since the invention of DRAM over 50 years ago, server and workstation memory has remained expensive, scarce, and volatile. Applications have been satisfied with the Von Neuman model of extending DRAM capacity by using IO to virtual memory in storage.

Not anymore. In-memory databases and fraud analytics in financial services, customer profiling in social media, recommendation engines in retail, 3D animation in media & entertainment, genomics in health sciences, and security forensics, to name just a few, are now demanding memory infrastructure with the capacity to handle massive data sets and avoid the performance hit of IO to storage.

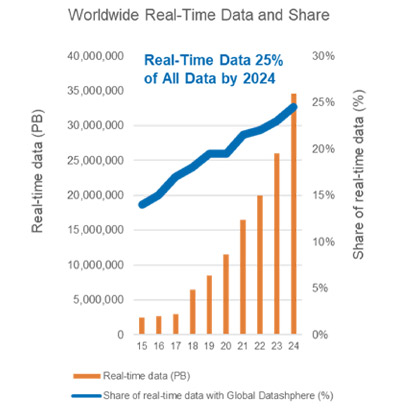

As you can see in the chart on the right, IDC projects real-time data will comprise almost 25% of all data by 2024. They also project in 2021, 60-70% of the Global 2000 will have at least one mission-critical real-time workload.

The Big Memory Imperative

Micron remarks suggest there is insufficient market validation for PMEM and Big Memory.

MemVerge’s opinion is the growth of real-time data and memory-centric apps are market validation of strong demand for higher PMEM density and lower cost. The explosion of memory-centric apps also validates a critical need for composable, software-defined memory with capacity, performance, availability, mobility, and security that can be tailored for each app.

Since the invention of DRAM over 50 years ago, server and workstation memory has remained expensive, scarce, and volatile. Applications have been satisfied with the Von Neuman model of extending DRAM capacity by using IO to virtual memory in storage.

Not anymore. In-memory databases and fraud analytics in financial services, customer profiling in social media, recommendation engines in retail, 3D animation in media & entertainment, genomics in health sciences, and security forensics, to name just a few, are now demanding memory infrastructure with the capacity to handle massive data sets and avoid the performance hit of IO to storage.

As you can see in the chart on the below, IDC projects real-time data will comprise almost 25% of all data by 2024. They also project in 2021, 60-70% of the Global 2000 will have at least one mission-critical real-time workload.

In 1968 Robert Dennard patented DRAM with a single transistor. In 1969 Intel introduced the 1103, the first commercial DRAM chip.

The growth of real-time data is driving data from storage into memory which is creating demand for higher capacity, lower cost, and persistent memory.

The Innovation Occurring to Meet the Big Memory Imperative

Micron says they will, “shift resources to focus on accelerating market introduction of CXL-enabled memory products.” This implies that 3D Xpoint™ technology will not be CXL-enabled.

The MemVerge point-of-view is that 3D Xpoint™ technology will be CXL-enabled. We see innovation occurring in 3 technology arenas that will make Big Memory Computing a reality. In the area of memory chips, innovations will include CXL-enabled DRAM from suppliers like Micron and CXL-enabled PMEM from suppliers like Intel.

The following are 3 areas of innovation that underpin Big Memory Computing:

1 – Memory Chips – different types of memory such as PMEM and MRAM are emerging to address requirements for cost, capacity, and persistence that can’t be addressed by DRAM.

2 – Fabric Interconnects – open standards like CXL will open the door for applications to leverage different types of processors and memory interconnected in a Big Memory fabric.

3 – Memory Virtualization Software – fabrics interconnected by CXL will need software, like Memory Machine from MemVerge, to abstract applications from the changes needed to support different processors and memory, and to make the memory resources composable.

When CXL is available, Big Memory fabrics will be there to support CXL-enabled DRAM, PMEM, and emerging memory, as well as heterogeneous processors.

The Bottom Line

Micron exiting the market for 3D Xpoint memory, and the comments in their announcement, calls into question the viability of persistent memory and Big Memory computing.

The bottom line is there is strong and growing customer demand to transform a market with a $100 billion revenue opportunity. Furthermore, the huge demand and revenue opportunity will drive continued investments in PMEM and Big Memory Computing.

MemVerge interprets the Micron announcement to mean they are exiting the market for 3D Xpoint to focus on their core DRAM and NAND businesses, leaving it to Intel, and others in the future to deliver CXL-compatible PMEM.

Watch MemVerge CEO Dr. Charles Fan talk about the Big Memory imperative driven by memory-centric apps, DRAM and PMEM with CXL, and what the Micron announcement about 3D XPoint means to Big Memory.

Frequent Questions and MemVerge Point-of-View

| Questions/Comments | MemVerge Point-of-View |

|---|---|

| Is there a market for PMEM? | Yes, and it’s huge. IDC is projecting that PMEM revenue will grow from $65M in 2019 to$ 2.6B in 2023. Coughlin & Associates projects PMEM shipments will equal DRAM shipments by 2030. |

| Why has adoption of PMEM been small after it’s been on the market since 2015? | A few press articles have said that PMEM has been available since 2015. In fact, Intel Optane Persistent Memory starting shipping in late 2019. In only 1-1/2 year, PMEM has made significant progress in terms of customer adoption and ecosystem support. |

| PMEM adoption has been hindered because apps must be modified to support it. | This is true. However, MemVerge software is designed specifically to overcome this limitation and make adoption of PMEM transparent, without sacrificing performance or capacity. |

| Is there software support for PMEM? | Already Oracle, SAP HANA, VMware, and Redis, to name just a few popular apps, have been modified to support PMEM. Again, MemVerge can facilitate app support without changes to the app. |

| Which types of memory will support CXL? | CXL is expected to be available in the next 2 years. When it is available, MemVerge expects Memory Machine software, DRAM, and PMEM to be CXL-compatible. |

| Will Intel be able to fab chips if they don’t buy the Micron fab in Idaho? | Intel has a fab in New Mexico that already has the capability to manufacture PMEM. Intel said in a statement, “Micron's announcement doesn't change our strategy for Intel Optane or our ability to supply Intel Optane products to our customers.” |